VOLATILE CURRENCY SINCE FREE FLOAT

The INR’s volatility is approximately 8.3% p.a. (against the USD) when measured as annualised volatility of monthly percentage changes over the past 25 years. It is even higher against the AUD at 10.9% p.a. Volatility heightened during 2012-13 as inflation rose, deficits at both the current account and fiscal level increased and economic growth slowed through poor execution by the prior Government. As investors withdrew their allocation to India over this period, the currency experienced significant weakness.

INDIA’S CENTRAL BANK AND MODI’S WIN

Since free float, the volatility of the Rupee reflects high inflation, low levels of foreign reserves and a lack of investor confidence in the economy. More recently the RBI, under the guidance of Raghuram Rajan, has had a stabilising effect. Interest rates were raised, not only in response to higher inflation, but making it expensive for speculators to take a short position.

Additionally, post the election win in May 2014 by the BJP Party, led by Narendra Modi, the India story has been promoted heavily, encouraging more positive sentiment towards investing in India. In fact the Rupee has been relatively strong against most other currencies, with the exception of the rate-hike fuelled USD (and the CNY which is pegged to the USD). As economic growth has reaccelerated, inflation has fallen and foreign reserves have been accumulated, the currency’s volatility has receded.

Chart 1: INR Performance vs Major Currencies/BRIC’s (May 2014-Oct 2015)

Source: India Avenue Research, Yahoo Finance

THE LAST 25 YEARS: AUD/INR

Over the last 25 years the average rate of depreciation against the AUD has been 3.6% p.a. This equates approximately to the cost of hedging currency exposure to the INR for an Australian investor.

Chart 2: AUD-INR Currency Movements (1992-2015)

Source: India Avenue Research, Bloomberg

Over the last 25 years the AUD has been strong relative to INR. Factors contributing to this have been:

- The Australian economy has been growing above trend since 1991

- Structural demand for commodities, driven by China’s industrialisation

- Australia’s high relative yields (compared to other highly rated sovereigns)

- India’s structural higher inflation

COST OF HEDGING INR EXPOSURE FOR AN AUSTRALIAN INVESTOR

Typically the interest rate differential between Australia and India has varied over time. Over the last 15 years, Australia’s interest rates have also been higher in response to higher inflation. As a result funds have flowed into Australia as foreign investors from regions like Japan and more recently Europe and the US have sought to benefit from higher rates.

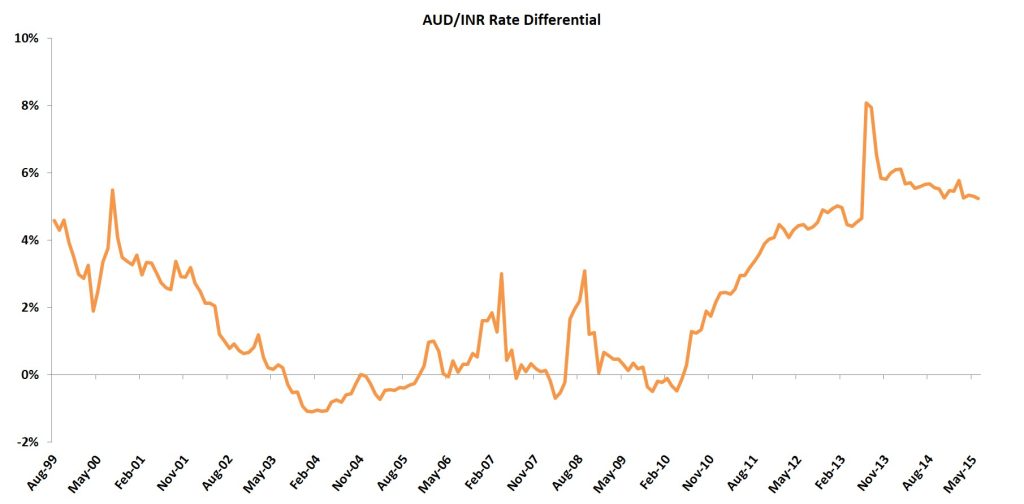

Chart 3: AUD/INR Interest Rate Differential – Cost of Hedging

Source: India Avenue Research, Bloomberg

With Australian cash rates now falling to 2%, the interest rate differential to India is high compared to history. Thus the cost of fully hedging currency exposure to the INR is now higher at 3.5-4% p.a. From a US investor’s perspective the cost has been even higher over time and is currently approximately 7% p.a.

The high cost tends to prevent investors from hedging their exposures or possibly avoiding exposure at all. Whilst India is likely to retain its status as a higher inflation, higher interest rate economy, there are other factors which can significantly influence movement of the AUD/INR cross.

OUTLOOK FOR THE INDIAN RUPEE VS AUSTRALIAN DOLLAR

Some of these factors below have been in play since 2013 as the AUD depreciated significantly and the INR started to stabilise:

- India’s growth likely to be well above Australia’s going forward (as forecasted by IMF)

- Structural demand for commodities falling due to weakening global growth

- India-Australia inflation spread likely to fall as infrastructure bottlenecks in India are reduced by its Government reform agenda

- Lower interest rates in Australia, leading to less foreign investment

Additionally, it appears likely that demand for Indian assets will increase, given its appeal as a high growth region, with a stabilising currency, a build-up of foreign exchange reserves and the potential for sovereign risk rating upgrades from S&P, Moody’s and Fitch.

INDIA AVENUE’S VIEW

On a long-term basis the Rupee is one of the most undervalued currencies relative to purchasing power parity. The discount is largely reflective of a high inflation economy, which has eroded the purchasing power of its currency over time.

[box] Going forward we expect that the Rupee will be a more attractive currency to own given that both growth assets and high yielding currencies will be heavily sought after, given their scarcity in a low growth/low inflation environment.[/box]

We would advocate investors maintain an unhedged exposure to the Rupee, particularly from an Australian investor’s perspective. The Rupee also has a low correlation to commodity prices, providing good diversification, given the linkages of the Australian economy .

Chart 4: Indian Rupee: Diversifier for Australian Investors

Source: Bloomberg, RBA, EIA, India Avenue Research

CONCLUSION

When investing in the capital markets of a foreign country, currency exposure is always a significant component of overall return. However, exposure to foreign markets and their currencies can provide considerable diversification benefits and a much broader opportunity set. For Australian investors this has been particularly pertinent due to the AUD’s significant depreciation over the past 18 months.

Exposure to Indian assets requires assessment of the Rupee’s potential impact on overall risk and returns. Fully hedging out currency exposure to a high interest rate economy can be costly and locks in a loss. This can have the effect of investors seeking alternate ways to gain exposure to the economy.

As India increases in its focus as an exciting investment destination for global investors, the impact of the Rupee’s movement will play an increasing level of significance and scrutiny for investors in their evaluation.

India Avenue is a boutique investment management firm providing investment solutions that allow our clients to benefit from India’s remarkable growth story.

OUR BUSINESS

2005

The journey towards the “birth” of India Avenue originated in 2005, when ING Investment Management started a business in India as a separate division, utilising a practiced multi-manager philosophy in markets like Australia, and exported it to India. Three of our founders, Mugunthan Siva, Rajeev Thakkar and Sajjan Raut Desai worked together for INGIM (India), building investment strategies and structures, under this philosophy and applying them to Indian capital markets

2011

In 2011 our founders started discussing the possibility of building an investment firm with a capability to provide a focus on India as an stand-alone investment jurisdiction for foreign investors. The founders identified Australia and New Zealand as nascent markets for investing in regional locations, with the potential to accelerate given education and insights which the firm could provide.

2015

By 2015 the group of founders decided to work full-time on this concept to bring it to life. They did this by leaving their existing employment, thus exercising high conviction in the investment region of India as a long-term structural story for investors in Australia and New Zealand. Thus, the firm India Avenue Investment Management was registered and came to life in 2015 in Sydney, Australia.

2016

After building our business for a period of 12 months, our first fund, The India Avenue Equity Fund was launched on 6th September 2016, with strong service provider partners like Equity Trustees (RE), Mainstream (Fund Administrator), KPMG (Fund Auditor) and BNP India (Custodian).

NOW

India Avenue is now a boutique investment business firm, with clients spread across family offices, high net worth individuals, wealth advisers and financial planning firms. Our firm has focused on education and knowledge as a driver of investment behaviour and have taken a long-term approach towards Australian and New Zealand investors contemplating an allocation to India’s growth as part of their portfolios. Our firm has assets in excess of A$50m and the India Avenue Equity Fund is rated “Recommended”* by Lonsec and is available on multiple investment platforms across Australia and New Zealand.